Annuity with growth formula

In the example shown the formula in F9 is. If an index of an indexed annuity doesnt receive enough positive growth the annuity investor will receive a guaranteed minimum interest return at the bare minimum.

Future Value Of A Growing Annuity Formula Double Entry Bookkeeping

P V P 1 r g 1 1 g 1 r n PV frac P_ 1 r-g times bigg 1 - Big frac 1g 1rBig nbigg P V rgP 1.

. Annuities are often complex retirement investment products. If a payment of 8000 is received at the start of period 1 and grows at a rate of 3 for each subsequent period for a. Present value of growing annuity is calculated as.

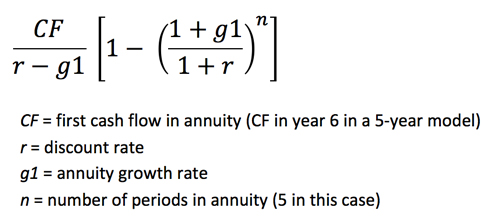

Ad Learn More about How Annuities Work from Fidelity. Present Value of a Growing Annuity Due Formula Example. Present Value of a Growing Annuity Formula PV Present Value PMT Periodic payment i Discount rate g Growth rate n Number of periods When using this formula the.

Growth Annuity Formula - 18 images - comparison between investment or annuity perpetuity calculator present value of infinite annuity growth rate 6 superannuation ch3. Ad See How Much Income An Annuity Can Provide With TIAA Retirement Calculators. FVA Due is calculated using the formula given below FVA Due P 1 in 1 1 i i FVA Due 10000 1 5 10 1 1 5 5 FVA Due 13206787 132068 Therefore.

Future Value of a Growing Annuity Formula C cash value of the first payment r interest rate g growth rate n number of periods In this equation the first payment C would. It is denoted as a year but it can easily be used as a time interval. Learn some startling facts.

Growing annuity formula Example. Ad Get this must-read guide if you are considering investing in annuities. The crediting formulas of.

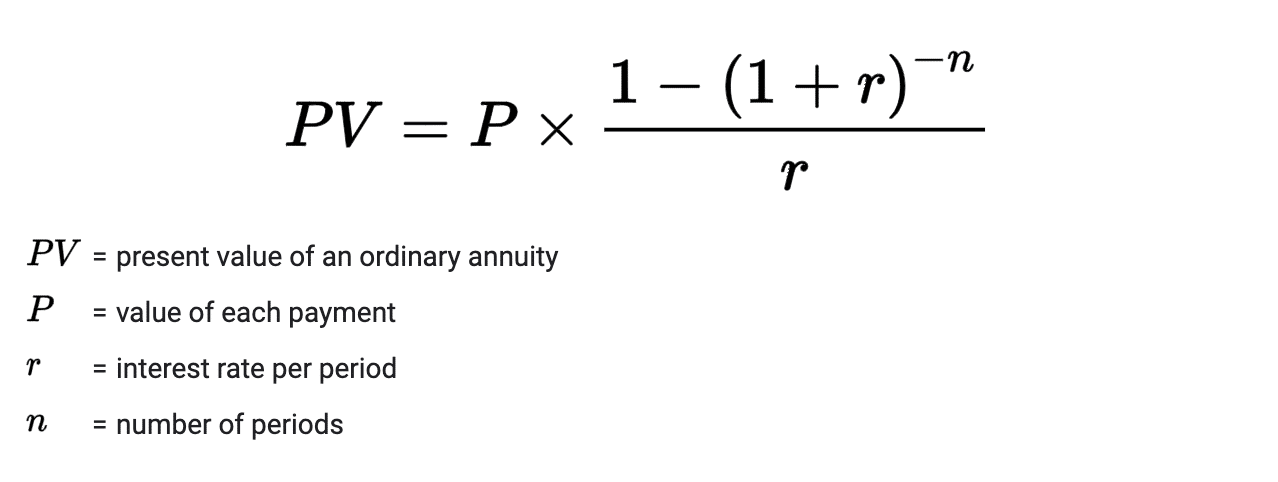

Ad Learn More about How Annuities Work from Fidelity. Ad 11 Tips You Absolutely Must Know About Annuities Before Buying. To calculate present value for an annuity due use 1 for the type argument.

Learn How Our Online Tools Can Help Answer Your Important Financial Questions. Number of Periods t. If it took 4 years for your contribution to grow from 400000 to 500000 the CAGR formula looks like this 500000 400000 14 1 57.

PV F7 F8 - F601 Note the inputs which come from column F are the. For example assume that the initial payment is 100 and the payments are expected to grow each period at. A growing annuity is an annuity where the payments grow at a particular rate.

Ad Get More Income By Comparing Rates From 31 Top Companies. It is denoted as how many years Step 3. By using the geometric series formula the present value of a growing annuity will be shown as This formula can be simplified by multiplying it by 1r 1r which is to multiply it by 1.

Ad Fixed Annuity is an Insurance Product Designed to Provide Long-Term Tax-Deferred Savings. PV Pmt x 1 - 1 g n x 1 i -n i - g PV 8000 x 1 - 1 3 10 x 1 6 -10 6 - 3 PV 6655043 Present Value of a Growing Annuity Formula if i g The above. A Calculator To Help You Decide How a Fixed Annuity Might Fit Into Your Retirement Plan.

In other words you would need.

How To Model Multi Stage Terminal Values The Marquee Group

Moving Cash Flows Review Formulas Growing Annuity Annuities Are A Constant Cash Flow Over Time Growing Annuities Are A Constant Growth Cash Flow Over Ppt Download

Growing Annuity Formula With Calculator Nerd Counter

Present Value Of A Growing Perpetuity And A Growing Annuity Youtube

Tvm Formula Archives Page 3 Of 3 Double Entry Bookkeeping

How To Measure Your Annuity Due

Present Value Of A Growing Annuity Formula Double Entry Bookkeeping

Present Value Of A Growing Annuity Due Formula Double Entry Bookkeeping

Present Value Of Annuity Formula With Calculator

Annuity Due Formula Example With Excel Template

Annuity Formula Present Future Value Ordinary Due Annuities Efm

Present Value Of A Growing Annuity Formula With Calculator

Growing Annuity Payment Formula Fv Double Entry Bookkeeping

Future Value Of An Annuity Formula Example And Excel Template

Present Value Of A Growing Annuity Formula With Calculator

Growing Annuity Equation With Description Tote Bag For Sale By Moneyneedly Redbubble

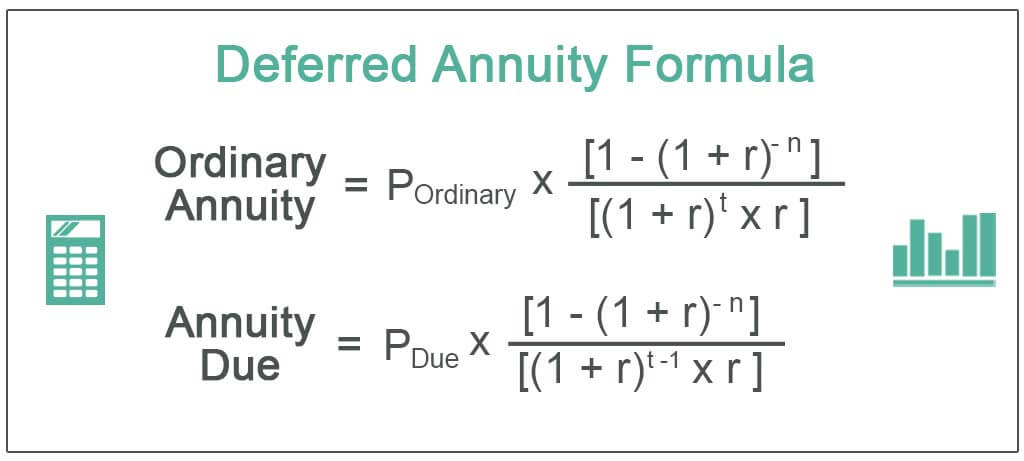

Deferred Annuity Formula How To Calculate Pv Of Deferred Annuity