1099 unemployment tax calculator

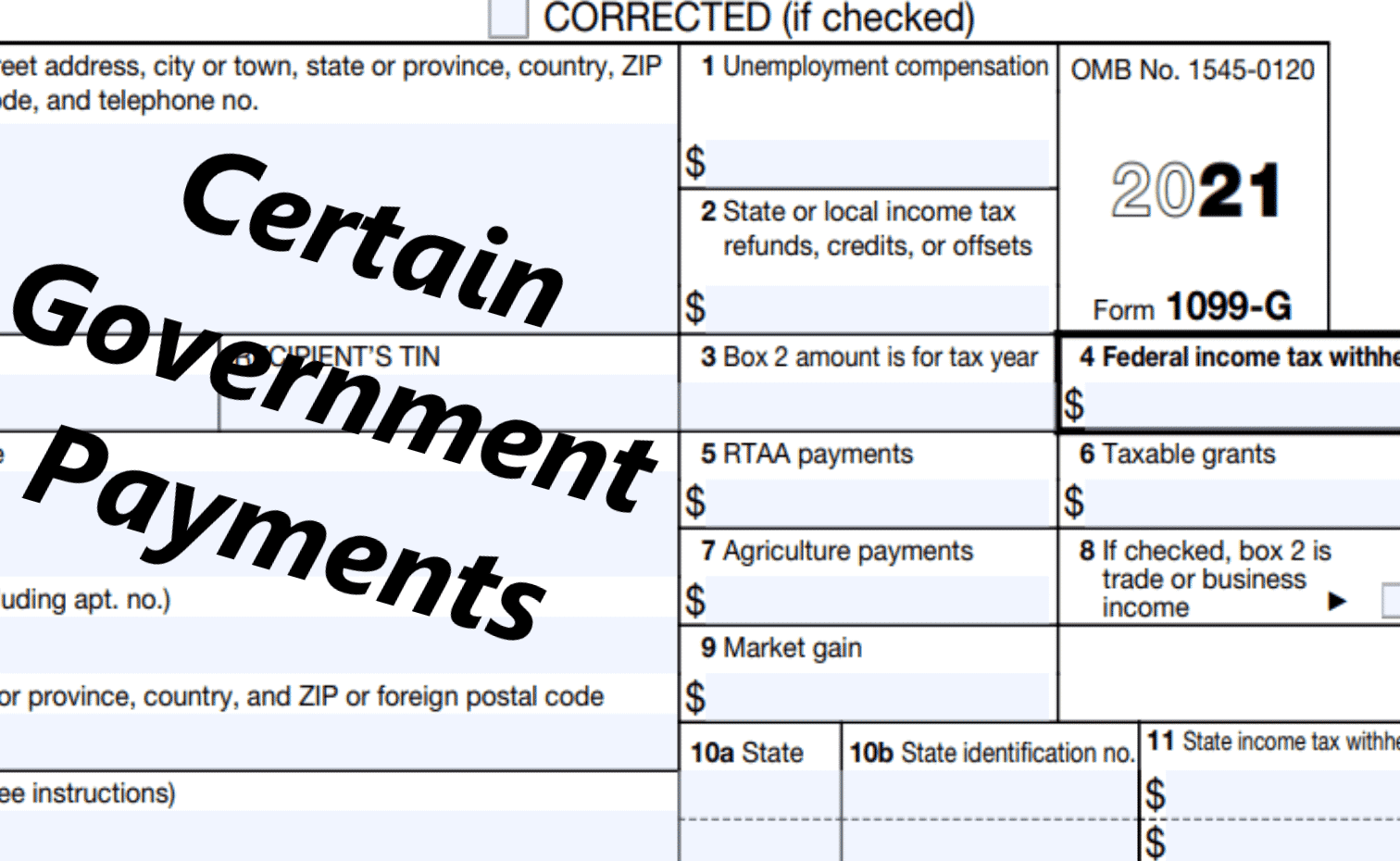

Insured work is work performed for employers who are required to pay unemployment insurance tax on your wages. Box 1 of the 1099-G Form shows your total unemployment compensation payments for the year.

1099 G 1099 Ints Now Available Virginia Tax

If youre wondering about the differences between tax forms 1040 and 1099 this primer is for you.

. Meaning if you were paid in 2020 for weeks of unemployment benefits from 2019 those will appear on your 1099-G for 2020. This calculator computes only an estimate based on the wage information you entered and does not guarantee any benefit amount or even if you will be eligible for unemployment benefitsEligibility and benefit amounts depend on a number of factors so if. The main types.

Form 1099-G Information 1099-G forms are automatically generated for all individuals where an unemployment compensation payment was made. Estimate your 2021 taxes. Best online tax calculator.

Free online income tax calculator to estimate US federal tax refund or owed amount for both salary earners and independent contractors. Form 1040 is the individual income tax form that most professionals are familiar with. In January IRS Form 1099-G will be mailed to you stating the amount of unemployment insurance benefits paid to you during the previous year as reported to the IRS.

March 31 if e-filed online with tax software. After completing her state tax return she realized she actually only owed 2500. The main types usually require the use of additional forms on your return.

For that tax year she chose to claim itemized deductions and deducted the 3000 state income from her federal income taxes. Due Date to Recipient. 1099 tax forms for non-investment income.

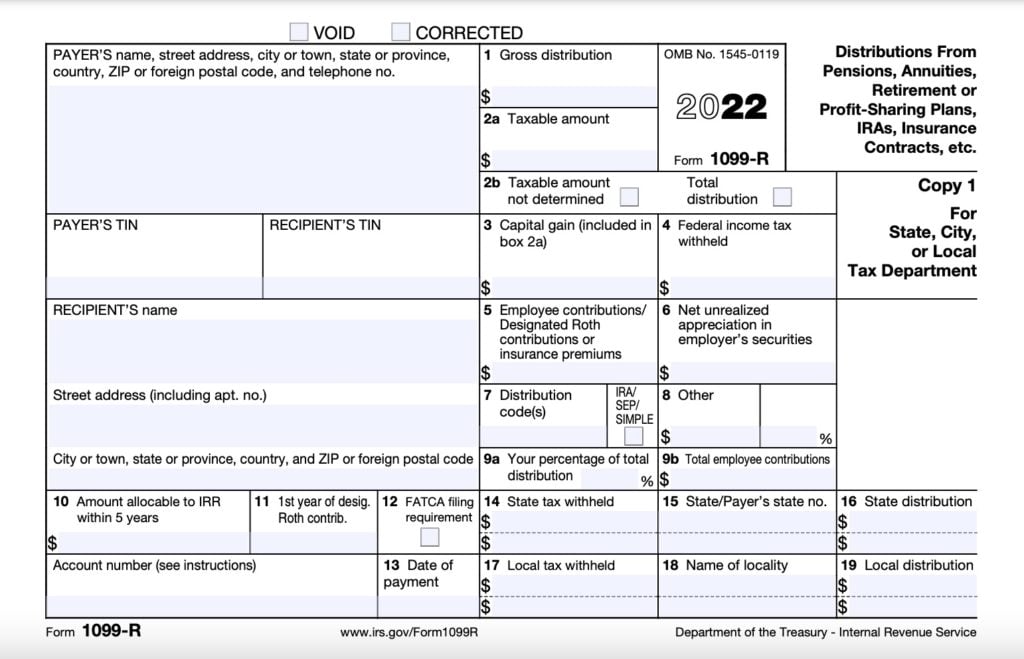

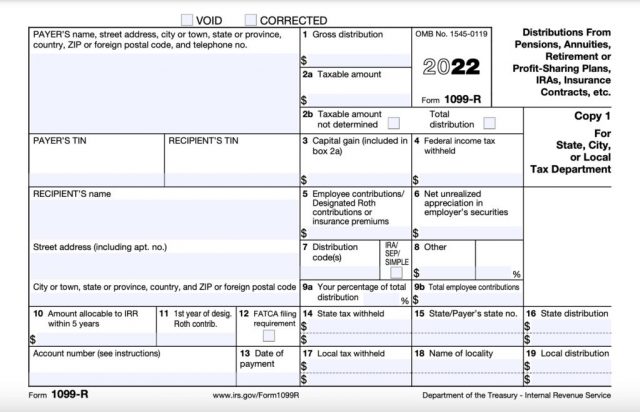

Form 1099-R Distributions From Pensions Annuities Retirement or Profit-Sharing Plans IRAs Insurance Contracts etc. 2021 Tax Calculator to Estimate Your 2022 Tax Refund. Fill in the step-by-step questions and your tax return is calculated.

Unemployment pay1099-G retirement pay 1099-R StateLocal Tax Rate. File 2020 Tax Return. My total tax payments.

These next two types of 1099 forms require you to report the income on Schedule C which is typically subject to self-employment tax or Schedule E. What the Numbers Mean. This calculator is for 2022 Tax Returns due in 2023.

You will receive one 1099-G for all unemployment benefits received. We recommend using our benefits calculator at. 1099-MISC Form is used to report many types of income.

These workers receive a 1099 form to report their income on their tax returns. Compare that to how taxes work for regular employees also known as W-2 employees These workers are on payroll so their companies will deduct taxes from their salaries or hourly wages. Taxable social security income.

Start with a free eFile account and file federal and state taxes online by April 18 2022 - if you miss this deadline you have until October 17. You only have to answer the survey once to unlock the tax calculator for 24 hours. Yes all unemployment benefits are considered regular income for tax purposes and so are subject to both federal and state income taxes.

Estimated tax payments. The term W-2 also refers to a type of tax form. Total tax withheld from forms W-2 and 1099.

Forgot Username or Password. For reporting unemployment compensation as well as any state or local income tax refunds during the year. If you received a 1099-G and did NOT file a claim for unemployment benefits complete the Declaration of Identity Theft form attach a copy of the 1099-G and any other documentation showing that a fraudulent.

The simplest explanation for the numbers 1040 and 1099 being used to refer to employees and freelancers istaxes. When you receive a refund offset or credit of state or local income. Similarly if you were paid for 2020 weeks in 2021 those will not be on your 1099-G for 2020 they will appear on your 1099-G for 2021.

In 2017 Marias state issued her a 500 refund on the amount of tax that was overpaid and sent her Form 1099-G to report the payment. Your 1099-G reflects the total amount paid to you in 2020 regardless of the week that payment represents. Yes No Self-Employment Form 1099-NEC or 1099-MISC.

1099s and W-2s are the tax forms employers use to report wages and taxes withheld for different workers. We are currently in the 2022 Tax Season for preparing and e-filing 2021 Taxes. Schedule 1 for Form 1040 includes a separate line for unemployment compensation in the income section.

Unemployment compensation and alimony. Real Estate Tax. Use the calculator below to estimate the unemployment benefits for which you may be eligible.

Due Date to IRS. CA state tax refund. The 1099-G form assists in reporting the income on your tax forms.

Income Tax Payments. It is not necessary to attach the 1099-G to your tax return. Yes No.

1099 workers are also known as self-employed workers or independent contractors. For mailed paper returns February 28. W-2 workers are also known as employees.

This Annual Tax Reference Guide Is For Any Business That Has Employees And Contractor Bookkeeping Business Small Business Accounting Small Business Bookkeeping

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

:max_bytes(150000):strip_icc()/Form1099-INT2022-5e04b7fa54e54d2789d24757e86b1bff.jpg)

1099 Int Interest Income

1099 G Unemployment Compensation 1099g

:max_bytes(150000):strip_icc()/1099-Rpdf1-b1fa4454f3af489aa717304e4667e415.jpg)

What Is A 1099 R

If You Don T Get Form 1099 Is It Taxable Will Irs Know Hint If A Tree Falls In The Forest

Doordash 1099 Taxes Your Guide To Forms Write Offs And More

1099 G Form 2021

How Do Food Delivery Couriers Pay Taxes Get It Back

Form 1099 Nec For Nonemployee Compensation H R Block

Solved Turbo Tax Tells Me I Need To Enter A State Identification Number Form 1099 G Box 10b But My 1099 G Form Is Grayed Out And Does Not Provide Me With One What

What S The Difference Between W 2 1099 And Corp To Corp Workers

What Is A 1099 R Tax Forms For Annuities Pensions

/1099-MISC-88cdf3af79f3437ea04b0666287c08a1.jpg)

Form 1099 Misc Miscellaneous Income Definition

Here Is The Difference Between The Form 1099 Nec And Form 1099 Misc Forbes Advisor

How Do Food Delivery Couriers Pay Taxes Get It Back

What Is A 1099 R Tax Forms For Annuities Pensions